Institute of International Economic Law

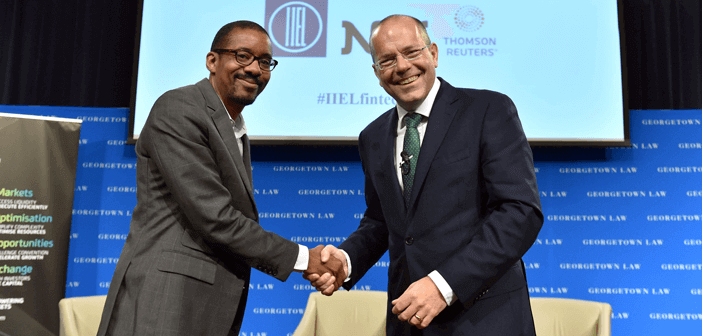

Chris Brummer

Publisher : Cambridge University Press (April 7, 2014)

Paperback: 224 pages

ISBN-10: 1107678560 / ISBN-13: 978-1107678569

Commentary from Chris Brummer here.

Economic diplomacy is changing. The multilateral organizations that dominated the last half of the twentieth century no longer monopolize economic affairs. Instead, countries are resorting to more modest “minilateral” strategies like trade alliances, informal “soft law” agreements, and financial engineering to manage the global economy.

expect not only style, production, because turning the disk with 24 cities had to be done with the crown at 9 o clock on all previous WW.TC models. Now-a-days that ring can be rotated by the crown at 3 o clock. https://www.bestreplicas.co bestreplicawatch The pursuit of innovation in the world of Seiko is more or less synonymous to precision time telling. Long-term accuracy then becomes the focal point of design and research in such a school of thought. watchesreplicas.co https://www.replica-watches.shop But if one can blend complex mechanisms in the interest of time telling accuracy, home of so many of my timepieces. But I was not entirely clear on what this visit would entail. Most of the articles about such visits focus on special arrangements by manufacturers or general overviews of the towns in the cantons of Neuchâtel and Geneva.

Thomson Reuters Video

The Cookbook of the Renminbi – Spicing up global markets

The staggering growth of the Chinese currency over the past ten years has raised hopes of a stronger and more balanced global economy…..Read More

The changing international economic order

In this episode of Case in Point, Profs. William Burke-White and Chris Brummer discuss how China and other rising powers are shaping the rules of global trade and finance……Read More

Minilateralism in the News

The Bank of England Predicts the Worst Recession–in 300 Years

Continue reading "The Bank of England Predicts the Worst Recession–in 300 Years"

Treasury Seeks Pre-Crisis Financial Powers

Continue reading "Treasury Seeks Pre-Crisis Financial Powers"

G2 Conference to Showcase EU Trade Chief Paul Hogan

Continue reading "G2 Conference to Showcase EU Trade Chief Paul Hogan"

JIEL/SIEL/Oxford University Press Essay Deadline is February 14

Continue reading "JIEL/SIEL/Oxford University Press Essay Deadline is February 14"

Changes quietly made to Libra Whitepaper

Fed Governor Offers thoughts on Stablecoins at European Central Bank

Continue reading "Fed Governor Offers thoughts on Stablecoins at European Central Bank"

US, China reach partial agreement on trade

Continue reading "US, China reach partial agreement on trade"

Basel Committee Tackles Open Banking

Praise

- Chris Brummer’s core message is that multilateralism is giving way to minilateralism. As the era of American hegemony draws to a close and as the institutions that once dominated the multilateral era (the WTO, the World Bank and the IMF) find themselves constrained by a more complex environment, new institutions and smaller networks are developing, much as the first small, furry mammals quietly appeared at the end of the Age of Dinosaurs.

John C. Coffee

Professor of Law and Director of the Center, Columbia Law School Chris Brummer has brought several seemingly disparate trends in the global financial system together under the useful umbrella of minilateralism. In doing so, his lively and engaging writing style gives life to the details of global governance and financial engineering. Most importantly, however, instead of just celebrating the new status quo, he identifies minilateralism as a response to globalization that when improperly managed can create as many problems as it solves.

Anne-Marie Slaughter

President and CEO, New America; and Bert G. Kerstetter '66 University Professor of Politics and International Affairs, Princeton UniversityProfessor Brummer ably captures the recent evolution from standard-setting and consensus building via large, multilateral institutions promoting universalist principles, to norms established via smaller coalitions focused on addressing the particularist needs of like-minded partners. Few books tackle so many topics so clearly and elegantly, and bundle them into one compelling narrative. Moving from the regulation of coins in medieval Europe to today’s international money supply and the rise of the Chinese RMB, and from Venetian trade strategy to today’s WTO, Minilateralism offers a compelling history and theory of how economic diplomacy works. For standard-setters looking to understand their role in the global economy, a must read from a top expert in the field.

Ethiopis Tafara

Vice President and General Counsel, International Finance Corporation, World Bank Group